NYC Real Estate Mid-2025: Navigating High Rates, Tight Inventory, and the Co-op Comeback

NYC Real Estate Mid-2025: Navigating High Rates, Tight Inventory, and the Co-op Comeback

As we move into mid-2025, the New York City real estate market continues its fascinating evolution. After a period of unprecedented volatility, we're witnessing a nuanced landscape characterized by persistent high interest rates, a tightening inventory of desirable properties, and a notable resurgence in the appeal of co-ops. For both seasoned New Yorkers and those looking to make their first move in the city, understanding these intertwined trends is paramount to making informed decisions.

At LucBlue Realty, our finger is firmly on the pulse of every borough, from Manhattan's bustling avenues to Brooklyn's vibrant brownstones, Queens' diverse neighborhoods, the Bronx's emerging communities, and Staten Island's distinct charm. We're here to break down what these key factors mean for you, whether you're buying, selling, or simply observing the market.

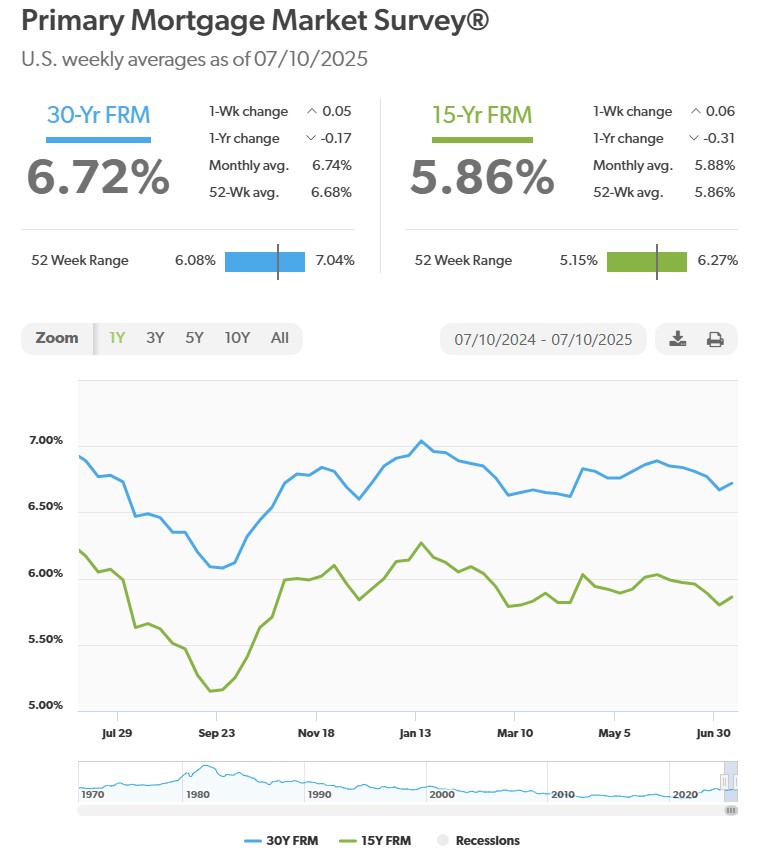

1. The Enduring Influence of High Interest Rates (Still the Elephant in the Room)

Despite earlier predictions of significant drops, mortgage interest rates have remained stubbornly elevated throughout 2025. As of early July 2025, 30-year fixed mortgage rates are hovering around 6.77% - 6.83%, with 15-year fixed rates around 5.86% - 6.14%. This continues to be the single biggest factor influencing buyer behavior and, consequently, seller strategies.

- Impact on Buyers: High rates directly affect affordability, increasing monthly mortgage payments and often reducing purchasing power. This forces many buyers to adjust their budgets, extend their search, or look for more creative financing options. Some buyers who were "on the sidelines" in previous years may now be re-engaging, having adjusted their expectations to this "new normal" for rates.

- Impact on Sellers: Sellers must understand that their buyer pool is sensitive to these rates. Properties that are strategically priced (and potentially open to negotiation) are more likely to attract qualified buyers. Overpricing in this environment leads to longer days on market and potentially multiple price reductions.

- The "Lock-In Effect": Many existing homeowners with lower, pre-2022 mortgage rates are hesitant to sell, as doing so would mean trading their favorable rate for a significantly higher one on their next purchase. This contributes to the overall tight inventory.

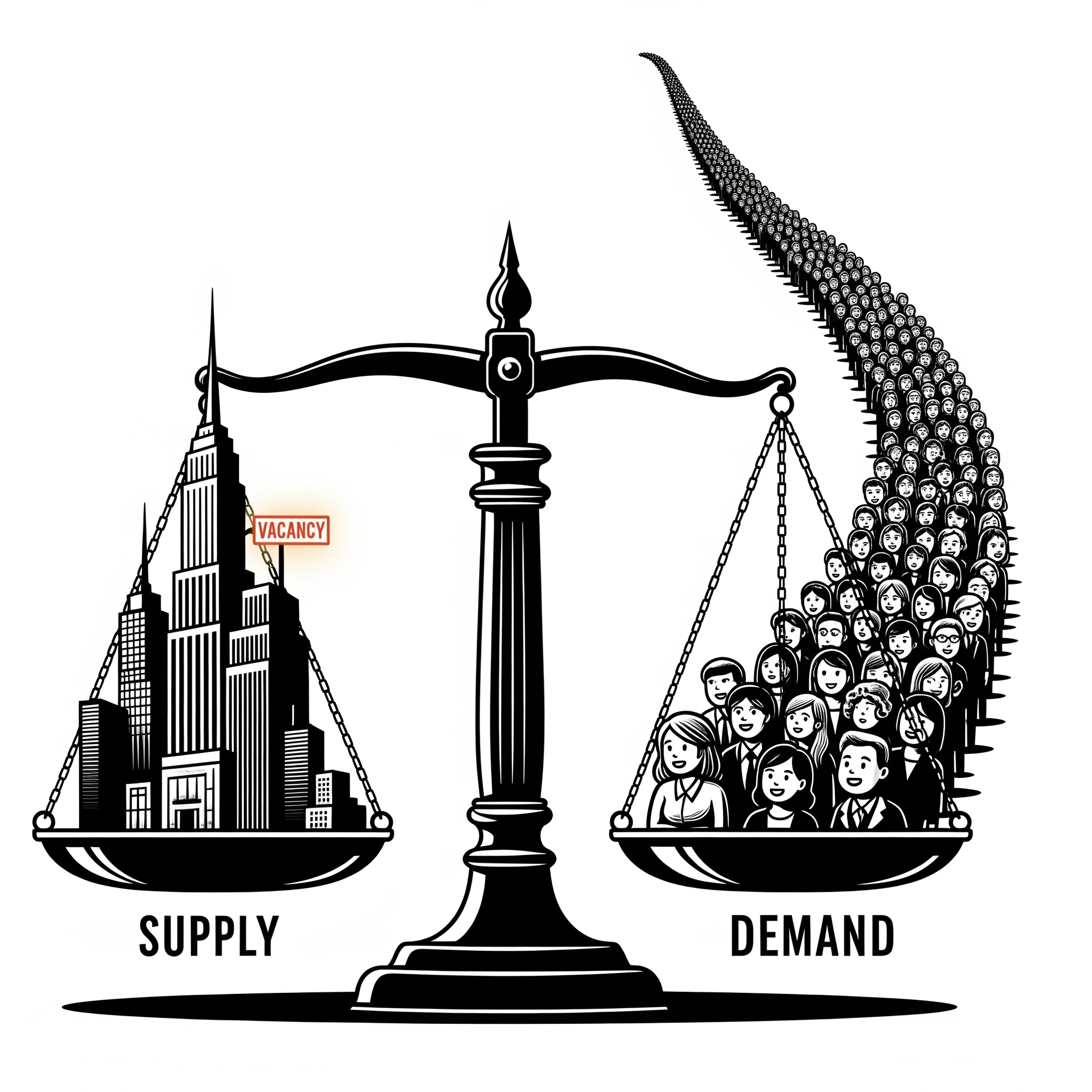

2. Navigating NYC's Tightening Inventory

Despite a recent uptick in new listings in some areas, overall active listing inventory across NYC remains tight, and in some segments, continues to shrink.

- Manhattan: Active listings declined 2% year-over-year in 2Q 2025, marking a full year of shrinking supply. Fewer new developments launched and more listings were pulled, contributing to this shortage. This is fueling competition and supporting price growth, with median prices reaching post-pandemic highs ($1.240M). Days on market fell to a three-year low (120 days).

- Brooklyn: While active listings climbed slightly by 2.7% as of late March, inventory still remains 17% below the 10-year Q1 average, underscoring historically tight supply for the borough. Move-in ready resale homes remain highly competitive.

- Queens: The median asking price in Queens jumped 12% in January 2025, largely due to condos taking a larger share of the market, even as co-ops remain the most common property. Inventory for co-ops has fallen.

- Bronx & Staten Island: While the Bronx saw a strong start to 2025 in Q1 with increased transaction volume, active listing count in Staten Island increased by 11.4% in March 2025, but 73% of homes still sold below asking price, indicating some negotiation power for buyers despite an overall "seller's market" designation.

- What it Means: Tight inventory, especially for move-in-ready properties, means that buyers must be prepared to act quickly and decisively when the right home appears. For sellers, while competition is lower, strategic pricing and impeccable presentation are crucial to stand out in a discerning market.

3. The Co-op Comeback: Value in a High-Rate Environment

One of the most significant trends gaining momentum in mid-2025 is the renewed interest in co-op apartments. In a market challenged by high interest rates and elevated prices, co-ops are offering a compelling value proposition.

- Significant Price Differential: Co-ops consistently come with a lower median price point than comparable condos. In Manhattan, for example, the median co-op price can be 20-30% lower than condos with similar square footage and amenities. This translates to hundreds of thousands in potential savings.

- Example: A Manhattan co-op median price in May 2025 was $825,000, while a condo was $1,150,000.

- Lower Closing Costs: Co-ops typically involve lower closing costs, as they avoid the mortgage recording tax (which can save 1.8-1.925% of your loan amount) and title insurance (0.4-0.5% of purchase price) usually associated with condos.

- More Space for Your Money: For the same budget, buyers can often get more square footage in a co-op. This is a powerful draw for those seeking to maximize their living space without significantly increasing their financial outlay.

- The Co-op Board Process: While co-ops offer financial benefits, buyers must be prepared for the often stringent and lengthy co-op board approval process, which involves in-depth financial scrutiny and interviews. This is a trade-off many buyers are now finding worthwhile in pursuit of affordability.

- Seller Opportunity: With fewer new co-op listings coming to market compared to condos, co-op owners looking to sell are often well-positioned, facing less competition and benefiting from increased buyer interest for their relatively lower-priced units.

Navigating Your Next Move with LucBlue Realty

Mid-2025 presents a dynamic and, in many ways, a more stable real estate market in New York City than we've seen in recent years. While high interest rates continue to shape affordability, buyers are adapting, and the allure of value-driven options like co-ops is growing. Tight inventory for desirable properties means that preparation and quick action remain key for buyers, while strategic pricing and presentation are paramount for sellers.

At LucBlue Realty, our deep understanding of these intricate market dynamics across Manhattan, Brooklyn, Queens, the Bronx, and Staten Island is what sets us apart. Whether you're a first-time buyer exploring the co-op market, a homeowner looking to sell strategically, or an investor seeking the next opportunity, our expert team provides the localized insights and personalized guidance you need.

Ready to make your move in NYC's evolving real estate landscape? Contact LucBlue Realty today for a personalized market analysis and strategic consultation tailored to your unique goals.

Categories

Recent Posts